Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC]

KCM • November 7, 2022

Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC]

Some Highlights

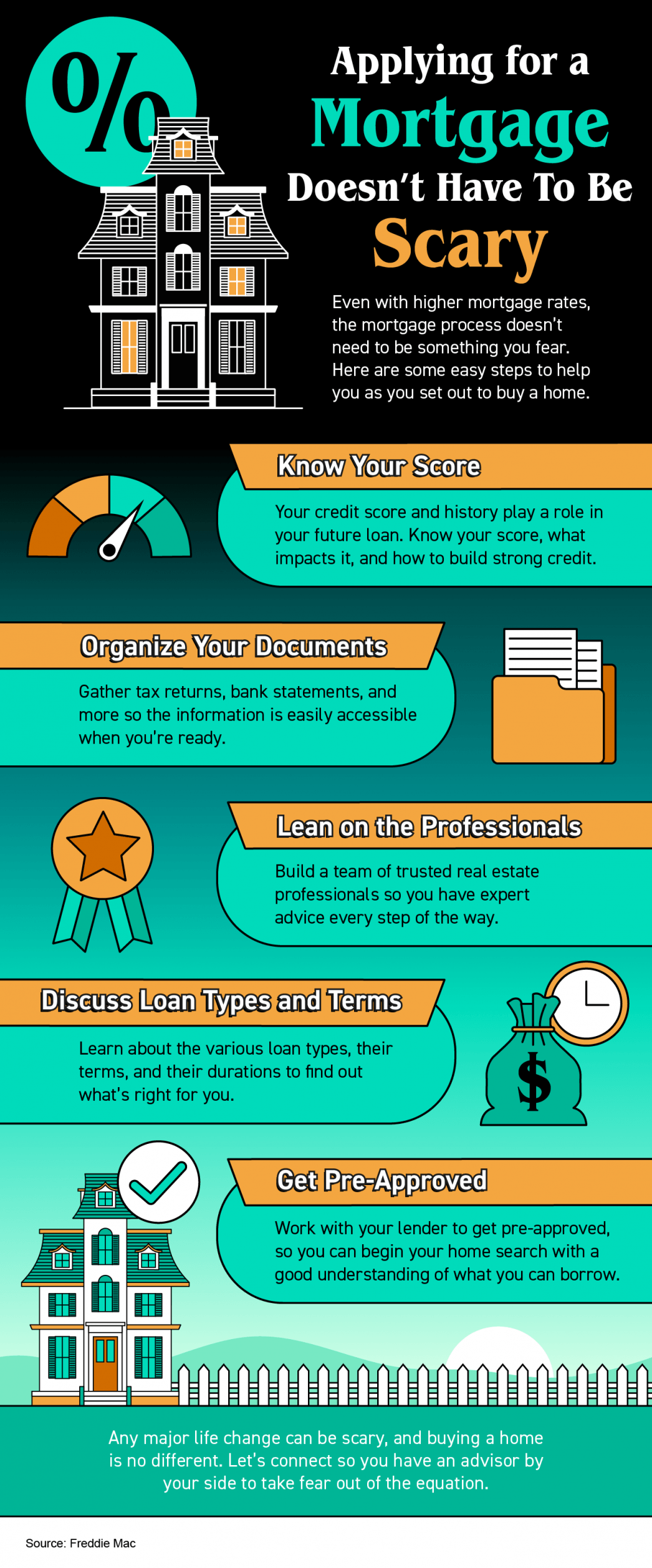

- Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home.

- Know your credit score and work to build strong credit. When you’re ready, lean on the pros and connect with a lender so you can get pre-approved and begin your home search.

- Any major life change can be scary, and buying a home is no different. Let’s connect so you have an advisor by your side to take fear out of the equation.

Share this post

News headlines can be misleading, and real estate news is no exception. Lately, you may have seen headlines warning that home contract cancellations have surged to a “record high” and are at their highest level since 2017. If you’re thinking about buying or selling, that might sound like something you should be concerned about. As a seller, it might make you wonder whether it’s going to be difficult — or even impossible — to get your house sold. As a buyer, you might question whether other buyers are sensing something you’ve missed and start second-guessing your decision. Or maybe you see it as a positive sign that the market is finally shifting back in favor of buyers. But before jumping to any conclusions, let’s take a closer look at what the data actually says so you have some real perspective. Let’s Put the Numbers in Context… Many of the articles reporting on this point back to a recent report stating that nearly 1 in 7 homes are falling through, which is a record for this time of year. In January 2026, 13.7% of pending home sales fell through, which is indeed the highest percentage of cancellations since January 2017. However, that’s only a 0.6 percentage point increase compared to last January, and a 2.7 percentage point increase compared to January 2017. For even more perspective, consider that during the ultra-competitive pandemic market — when homes were receiving multiple offers within days and buyers were waiving contingencies left and right — contracts still fell apart. Cancellations happen in hot markets. They happen in slow markets. They happen in balanced markets. So yes, technically speaking, the headlines are true. But when you look at the numbers in context, it’s far less dramatic than it may initially sound. What Does a “Cancellation” Actually Mean? Before reading too much into the word cancellation, it helps to understand what that actually means in real estate terms. A cancellation simply means a pending contract didn’t make it all the way to closing. And that can happen for a wide range of reasons. For instance: A buyer might get cold feet. Inspection issues may cause one party to walk away. Financing can fall through. An appraisal might come in lower than expected. Or personal circumstances — like a job loss or health issue — can change someone’s plans. In other words, not every cancellation is some dramatic signal about the overall housing market. And when a contract falls through, that doesn’t automatically mean the house won’t sell at all. In many cases, another buyer steps in. Sometimes it’s the person whose offer was originally beaten out in a multiple-offer situation. Other times it’s a completely new buyer who comes along once the home returns to active status. For sellers, a cancellation can certainly be frustrating, but it’s rarely the end of the road. And for buyers, it’s not evidence that “everyone else knows something you don’t.” It’s just something that happens to a certain percentage of real estate transactions each and every day, week, month, and year. Why Local Context (And Your Agent) Matter Most Because cancellations are a normal part of the process, the real question isn’t whether they happen… it’s whether they’re likely to happen to you, and how you handle it if it happens. National headlines talk in broad percentages. But real estate market conditions can vary significantly from one city to another, from one neighborhood to the next, and even between different price points within the same town. An experienced local agent can give you perspective on what’s happening specifically in your market, not just what’s happening nationally. More importantly, a good agent can often help reduce the likelihood of a contract falling through in the first place. That might mean properly vetting a buyer’s financing, structuring smart contingencies, pricing strategically, anticipating appraisal challenges, or identifying potential red flags early. But most importantly, when a cancellation does happen (and sometimes it will), an experienced agent can help you stay calm and make rational decisions instead of emotional ones. The Takeaway: According to recent headlines, real estate contract cancellations are at their highest January level since 2017. However, while that might sound alarming, it’s only a 0.6 percentage point increase compared to last January, and a 2.7 percentage point increase compared to January 2017. While those claims are factually correct, cancellations are a normal occurrence, and the increases are not as drastic as they may sound. Headlines are designed to grab attention. Before letting a headline impact whether you decide to buy or sell a home, make sure you’re looking at the full picture — ideally with a local agent who understands how it applies to you locally.

The Price You Set Can Make (or Break) Your Sale There’s one decision you're going to make when you sell that determines whether your house sells quickly, or it sits. Whether buyers make an offer, or scroll past it. Whether you walk away with the maximum return, or you end up cutting the price later. And that’s your asking price . The #1 Mistake Sellers Make Today: Trusting the Wrong Number If you’re thinking of moving and trying to figure out what your house may sell for, it’s tempting to start with an online home value tool. They’re fast, free, and easy. And you don’t have to talk to anyone. But here’s the problem: they don’t know your house. And that can be a bigger drawback than you realize. Where Online Estimates Fall Short Online tools often lag behind the market. They look in the rearview mirror, relying on closed sales and delayed information. And in that sense, they’re using incomplete data . That’s not a miss in how these systems are built. Some information just isn’t available online. Bankrate explains: “ While these tools can be a useful starting point, keep in mind that they typically do not provide the most accurate pricing. Algorithms can only rely on the information available; they can’t account for things like a home’s condition or renovations made since the last public information was updated.” They can’t see: The unique features that make your house special All the work you’ve put in to keep it in good condition Or, how in-demand your specific neighborhood is right now So, while they may do a good job in some cases, they can’t be as accurate as a local agent who has boots on the ground day in and day out. In a market where buyers have more options, a seemingly small margin of error can cost you thousands if you price too low, or weeks of lost momentum and time if you price too high. If you want to sell for the most money and in the least amount of time, you don’t want the fast answer on how to price your house. You want the right one. That’s why the savviest homeowners today don’t rely on algorithms when it actually matters. They rely on people, specifically trusted local agents. What an Expert Agent Brings to the Table According to 1000WATT , sellers overwhelmingly believe real estate agents have the best sense of a home’s true value, far more than any automated tools. That confidence isn’t accidental. As Bankrate puts it: “A professional appraiser or real estate agent can visit the home in person, assess the neighborhood as a whole as well as the individual property, perform more thorough market research, and consider subjective details.” And those details matter. A skilled local agent doesn’t just pull reports. They know what’s happening right now: What buyers are paying this month, not last month, or even last year How your home compares to the current competition in your neighborhood Which features add value based on what buyers are willing to pay for today How to price your house to create urgency in this market And once an agent steps foot in your house, they may even find your online estimate undershot your value. So, if you stuck with the estimate you got online, you’d actually be leaving money on the table. And no one wants that. Bottom Line While online tools can give you a rough starting point, only a local expert can give you a price that actually works. If you want to know the right number for your house, not just the easiest one to find, let’s talk.