Homeowners Have a Lot of Equity Right Now [INFOGRAPHIC]

KCM • September 13, 2023

Homeowners Have a Lot of Equity Right Now [INFOGRAPHIC]

Some Highlights

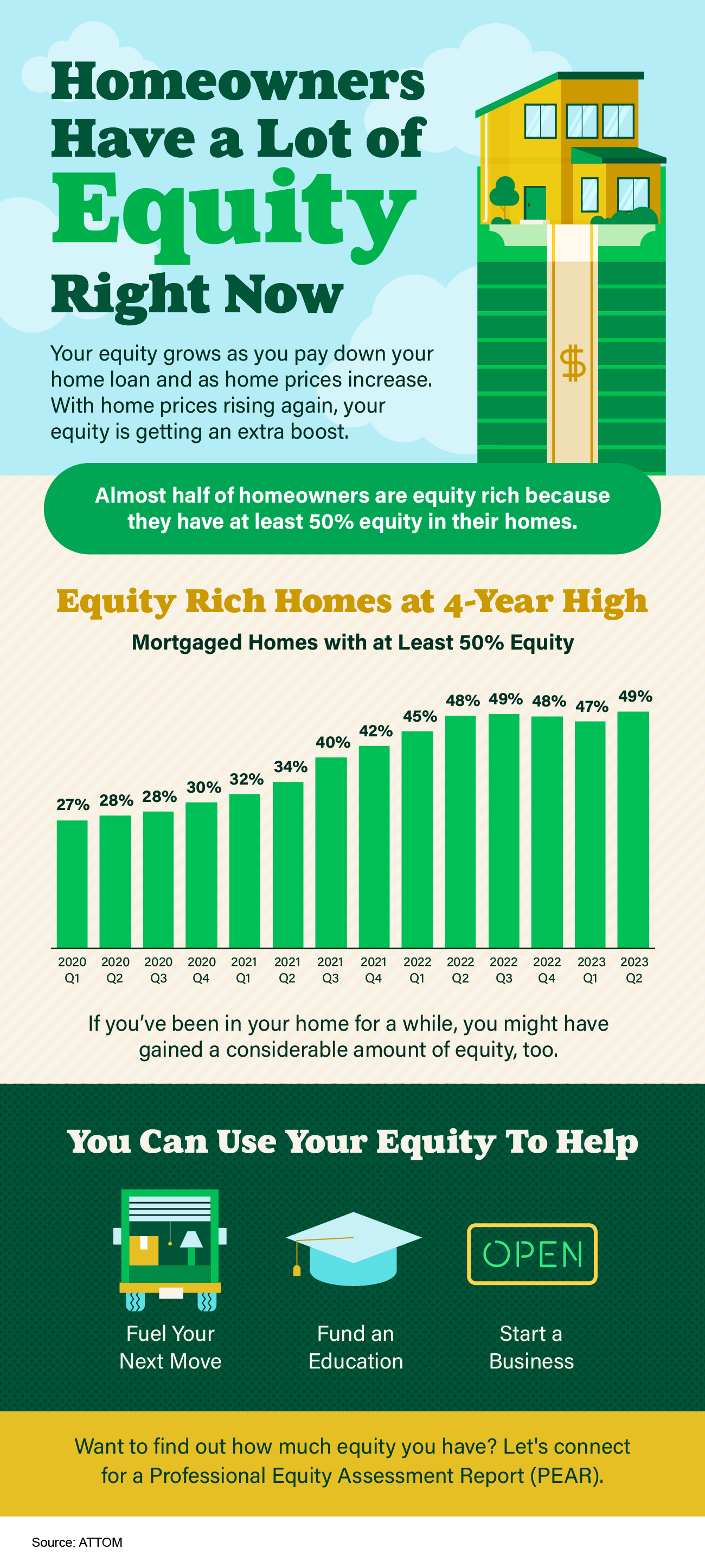

- Your equity grows as you pay down your home loan and as home prices increase. With home prices rising again, your equity is getting an extra boost.

- Almost half of homeowners are equity rich because they have at least 50% equity in their homes. If you’ve been in your home for a while, you might have gained a considerable amount of equity, too.

- Want to find out how much equity you have? Connect with a trusted real estate agent for a Professional Equity Assessment Report (PEAR).

Share this post

How Your Equity Could Help Younger Generations Buy a Home For a lot of parents or grandparents, watching a family member struggle to buy their first home right now is hard. That's because you saw firsthand how homeownership gave your life more stability and helped grow your net worth – and you want your loved ones to have those same opportunities. But with all the affordability challenges in recent years, that can feel like an uphill battle – even though it’s slowly improving lately. Here’s what you may not realize. You may be in a unique position to help (thanks to the equity in your current house). The Equity Advantage You May Not Be Thinking About You’ve likely owned your home for years, maybe even decades. And during that time, two things happened: Home values rose Your mortgage balance shrank (or you paid it off entirely) That combination has created substantial equity for many homeowners like you. And while you may think of that equity as something you want to have in your pocket for retirement, it can also serve another purpose: helping the next generation clear the biggest hurdle in their way. The #1 Thing Holding Young Buyers Back When John Burns Research & Consulting (JBREC) asked renters what’s keeping them from buying, the top answer wasn’t mortgage rates or home prices. It was the upfront cost, particularly saving enough for their down payment (see graph below): That’s where you may be able to make more of a difference than you realize. You can’t control rates or prices. But you may be able to use your equity to help with this upfront expense. And giving money to your loved one so they buy a home doesn’t mean putting your own future at risk. Even a small portion of your equity can put them in a position to finally get the keys to their first place – and, if you’re strategic about it, you’d still have a lot leftover for when you retire. With an estimated $68 and $84 trillion of wealth expected to transfer from older generations to younger ones over the next two decades, many families are already thinking differently about when and how that wealth will be passed down. Maybe it makes sense for your family to think about too. Help from Loved Ones Is Making a Move Possible for Many First-Time Buyers A growing share of young buyers are using gifts and loans from their loved ones to springboard into homeownership. According to the National Association of Realtors (NAR), nearly 1 in 5 first-time buyers use a cash gift from their family or loved ones for their down payment. And other young buyers are using their inheritance or a loan from someone they know to finally break into the market (see charts below): This Is About Opportunity, Not Obligation Every family’s situation is different, and your decision should be made carefully. It’s just that, if you’ve built up a lot of equity, you may have more room to help than you think. It’s not just a financial gift. It’s giving stability, security, and a foundation that could change their lives for the better – especially at a time when they may not be able to do it on their own. Bottom Line If you’re curious what your home equity could make possible, for you or for your loved ones, let’s start with a simple conversation. Because sometimes the most meaningful investment you can make is for the next generation.

How to Effectively Market Your Reno Rental Navigating the dynamic rental market requires a strategic approach to attract reliable tenants and maximize returns. Whether you own a single-family home or need commercial property management in Reno, effectively showcasing your investment is paramount. With competition growing among property management companies in Reno, NV, we understand that a robust marketing strategy is the foundation of long-term success.

Top Mistakes Homeowners Are Making in 2026 (And How To Avoid Them) Let’s be clear: selling your house is absolutely possible right now. According to the National Association of Realtors (NAR), roughly 11k homes sell every day in this country. And the sellers who are making their moves happen all have one thing in common: they’ve adjusted their strategy to match today’s market. They’re realizing inventory has grown. Homebuyers are more selective. And buyer expectations are higher. The sellers who struggle are usually approaching today’s market with yesterday’s expectations. Here are the three biggest mistakes they're making – and how to avoid them. 1. Pricing Based on What Their Neighbor Got a Few Years Back Setting your price is the most important decision you make when you sell – and the one that’s most often mishandled. Realtor.com data shows almost 1 out of 5 sellers in 2025 had to drop their price. Here’s what those sellers went wrong. Buyers have more choice and more negotiating power now that inventory has grown. And house hunters will actively avoid your house is if feels like it’s priced too high. That's why overpricing usually leads to: Fewer showings Less competitive (or lowball) offers Longer time on market And all three of those side effects are things you don’t want to deal with. What To Do Instead: The good news is the cure is simple. Just price for today’s buyer, not yesterday’s headlines. Lean on your agent’s knowledge of recent comparable sales, current competition, and local buyer behavior to land in the value “sweet spot” that drives traffic and urgency from day one. 2. Trying To Skip Repairs That Buyers Now Expect A few years ago, you could sell as-is and still get well above asking. Today? Not so much. Right now, NAR says two-thirds of sellers are making at least some repairs. And the reason why is simple. In a market with more inventory, buyers compare homes side by side. Homes that don't show well (or feel dated) are going to lose attention quickly, even if the issues are minor. What To Do Instead: Ask your agent which high-impact, low-stress updates they’d recommend for your house. The goal isn’t perfection. It’s helping buyers see themselves moving in without a mental to-do list. Small investments in staging, repairs, and curb appeal can make a huge difference in how quickly offers come in – and how strong those offers are. 3. Playing Hardball When Buyers Try To Negotiate Today’s buyers have housing affordability at the top of their minds. And since money is already tight, they’ll be pickier and will probably ask for some compromises from you. Whether that’s making repairs, giving them a credit at closing, or taking just a few thousand dollars off your asking price, negotiating is normal again. So, if something pops up in the inspection, you’re going to need to be open to talking about it. If you’re not, you may very well see your buyer walk away. And some sellers are figuring this out the hard way. Redfin data shows one of the big reasons home sales fell thru in 2025 was inspection or repair issues. Odds are those homeowners weren’t willing to flex a bit to get the deal done. What to Do Instead: Meet with your agent to make sure you understand what buyers in your area care the most about. Align your price with value, present the home clearly and confidently, and stay open to reasonable negotiations that keep deals moving forward. Bottom Line The sellers who succeed in this market aren’t doing anything extreme. They’re pricing their house right, making strategic repairs, getting local guidance, and making decisions based on how buyers actually behave today. Those small but mighty mindset shifts could make or break your sale. Want a real plan tailored to your home and your neighborhood? Let’s talk.