Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC]

KCM • June 19, 2023

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC]

Some Highlights

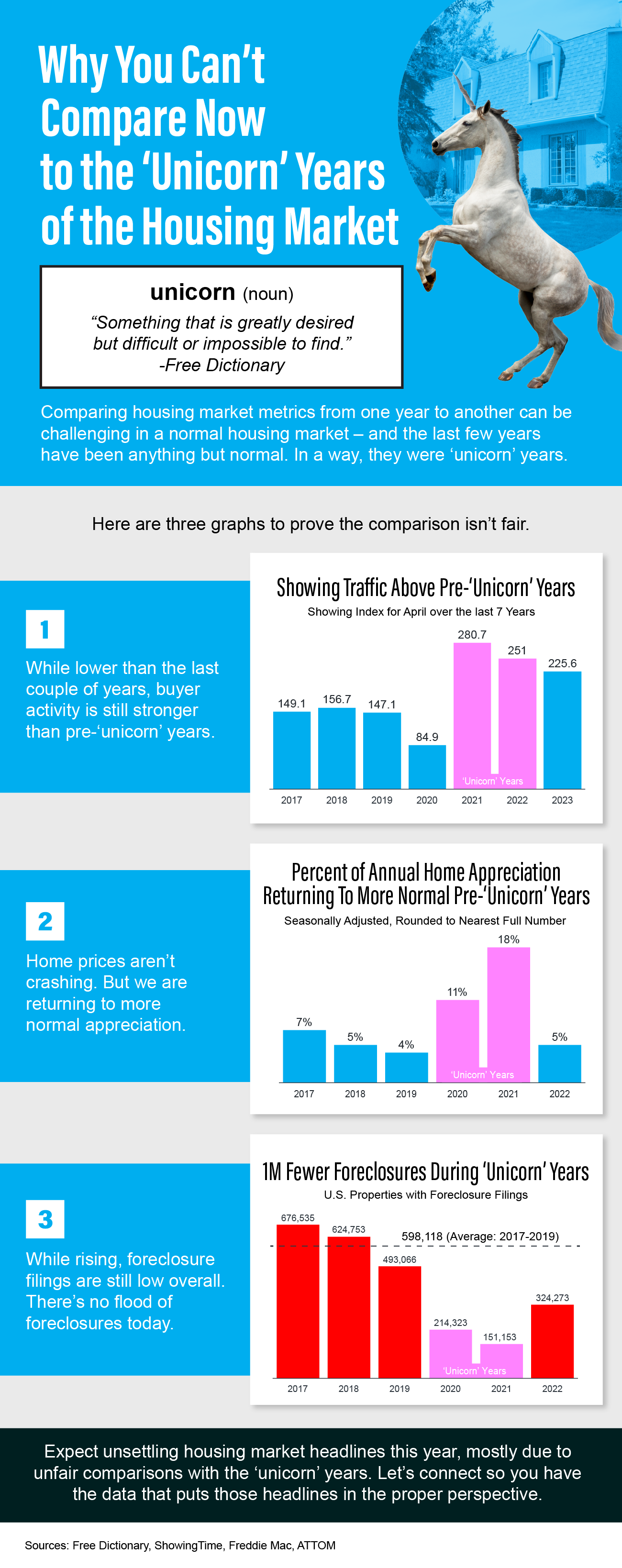

- Comparing housing market metrics from one year to another can be challenging in a normal housing market – and the last few years have been anything but normal. In a way, they were ‘unicorn’ years.

- Expect unsettling housing market headlines this year, mostly due to unfair comparisons with the ‘unicorn’ years.

Let’s connect so I can share the data that puts those headlines in the proper perspective. The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Share this post

Top Mistakes Homeowners Are Making in 2026 (And How To Avoid Them) Let’s be clear: selling your house is absolutely possible right now. According to the National Association of Realtors (NAR), roughly 11k homes sell every day in this country. And the sellers who are making their moves happen all have one thing in common: they’ve adjusted their strategy to match today’s market. They’re realizing inventory has grown. Homebuyers are more selective. And buyer expectations are higher. The sellers who struggle are usually approaching today’s market with yesterday’s expectations. Here are the three biggest mistakes they're making – and how to avoid them. 1. Pricing Based on What Their Neighbor Got a Few Years Back Setting your price is the most important decision you make when you sell – and the one that’s most often mishandled. Realtor.com data shows almost 1 out of 5 sellers in 2025 had to drop their price. Here’s what those sellers went wrong. Buyers have more choice and more negotiating power now that inventory has grown. And house hunters will actively avoid your house is if feels like it’s priced too high. That's why overpricing usually leads to: Fewer showings Less competitive (or lowball) offers Longer time on market And all three of those side effects are things you don’t want to deal with. What To Do Instead: The good news is the cure is simple. Just price for today’s buyer, not yesterday’s headlines. Lean on your agent’s knowledge of recent comparable sales, current competition, and local buyer behavior to land in the value “sweet spot” that drives traffic and urgency from day one. 2. Trying To Skip Repairs That Buyers Now Expect A few years ago, you could sell as-is and still get well above asking. Today? Not so much. Right now, NAR says two-thirds of sellers are making at least some repairs. And the reason why is simple. In a market with more inventory, buyers compare homes side by side. Homes that don't show well (or feel dated) are going to lose attention quickly, even if the issues are minor. What To Do Instead: Ask your agent which high-impact, low-stress updates they’d recommend for your house. The goal isn’t perfection. It’s helping buyers see themselves moving in without a mental to-do list. Small investments in staging, repairs, and curb appeal can make a huge difference in how quickly offers come in – and how strong those offers are. 3. Playing Hardball When Buyers Try To Negotiate Today’s buyers have housing affordability at the top of their minds. And since money is already tight, they’ll be pickier and will probably ask for some compromises from you. Whether that’s making repairs, giving them a credit at closing, or taking just a few thousand dollars off your asking price, negotiating is normal again. So, if something pops up in the inspection, you’re going to need to be open to talking about it. If you’re not, you may very well see your buyer walk away. And some sellers are figuring this out the hard way. Redfin data shows one of the big reasons home sales fell thru in 2025 was inspection or repair issues. Odds are those homeowners weren’t willing to flex a bit to get the deal done. What to Do Instead: Meet with your agent to make sure you understand what buyers in your area care the most about. Align your price with value, present the home clearly and confidently, and stay open to reasonable negotiations that keep deals moving forward. Bottom Line The sellers who succeed in this market aren’t doing anything extreme. They’re pricing their house right, making strategic repairs, getting local guidance, and making decisions based on how buyers actually behave today. Those small but mighty mindset shifts could make or break your sale. Want a real plan tailored to your home and your neighborhood? Let’s talk.

Renting vs. Buying: The Numbers Might Surprise You Renting can feel like the easier choice right now. There’s no big down payment. No dealing with surprise repairs. And no long-term commitment. But then your rent goes up again. And again. And suddenly the thing that seemed flexible starts looking… expensive , especially considering you’re not building any equity. And once that happens, it’s easy to feel a little trapped in the cycle. That’s because there’s so much chatter today about how buying a home isn’t affordable. But the truth is, the math may work out better than you'd expect based on what’s changed recently. Buying Is More Affordable Than Renting in Many Areas In a lot of places today, owning a home actually costs less each month than renting a 3-bedroom home. And recent data from ATTOM shows that’s true in nearly 58% of counties across the U.S. (see chart below). And that's after you factor in things like insurance and typical maintenance costs. In other words, even though it may feel like a bit of a shock, the numbers show rent often stretches monthly budgets more than owning does. That’s thanks to slower home price growth, more homes for sale , and monthly mortgage payments starting to ease as rates come down. Affordability Still Varies by Region Now, even though nationally the balance has shifted, that doesn’t mean buying is more affordable in every market or for every renter. While buying is more affordable than renting in nearly 58% of counties nationwide, that share looks different depending on your region (see graph below): The biggest improvement is happening in the Midwest and South. But if you’re living in the West, things could still feel tight. The takeaway? How affordable buying is really depends on where you live. And the only way to know how this plays out where you live is to look at the numbers locally. So, What’s Still Holding Buyers Back? Maybe you’re nodding along so far but thinking, “Okay, but I still can’t afford the upfront costs.” If that’s your reaction, you’re not the only one. For many renters, the biggest hurdle isn’t the monthly payment alone. It’s the down payment, too. But you’re not out of options. Here’s the part most people don’t hear enough about: there are thousands of down payment assistance programs available across the country, and many buyers qualify without realizing it. And the average benefit? Roughly $18,000 . That kind of support can help cover part of your down payment or closing costs , which means you may not need to save nearly as much as you think to get started. When you combine that with monthly payments that may work better than expected, especially as rates continue to ease and prices cool, buying may feel far more realistic than it looks at first glance. Bottom Line The point isn’t that everyone should rush out and buy a home tomorrow. It’s that renting isn’t always the more affordable option people assume it is – and buying may be more realistic than it feels once you look at the full picture. If you’re renting and feeling stuck in the “someday” loop, it might be worth a simple conversation. Just a chance to see what’s possible and whether it makes sense for you.

News headlines can be misleading, and real estate news is no exception. Lately, you may have seen headlines warning that home contract cancellations have surged to a “record high” and are at their highest level since 2017. If you’re thinking about buying or selling, that might sound like something you should be concerned about. As a seller, it might make you wonder whether it’s going to be difficult — or even impossible — to get your house sold. As a buyer, you might question whether other buyers are sensing something you’ve missed and start second-guessing your decision. Or maybe you see it as a positive sign that the market is finally shifting back in favor of buyers. But before jumping to any conclusions, let’s take a closer look at what the data actually says so you have some real perspective. Let’s Put the Numbers in Context… Many of the articles reporting on this point back to a recent report stating that nearly 1 in 7 homes are falling through, which is a record for this time of year. In January 2026, 13.7% of pending home sales fell through, which is indeed the highest percentage of cancellations since January 2017. However, that’s only a 0.6 percentage point increase compared to last January, and a 2.7 percentage point increase compared to January 2017. For even more perspective, consider that during the ultra-competitive pandemic market — when homes were receiving multiple offers within days and buyers were waiving contingencies left and right — contracts still fell apart. Cancellations happen in hot markets. They happen in slow markets. They happen in balanced markets. So yes, technically speaking, the headlines are true. But when you look at the numbers in context, it’s far less dramatic than it may initially sound. What Does a “Cancellation” Actually Mean? Before reading too much into the word cancellation, it helps to understand what that actually means in real estate terms. A cancellation simply means a pending contract didn’t make it all the way to closing. And that can happen for a wide range of reasons. For instance: A buyer might get cold feet. Inspection issues may cause one party to walk away. Financing can fall through. An appraisal might come in lower than expected. Or personal circumstances — like a job loss or health issue — can change someone’s plans. In other words, not every cancellation is some dramatic signal about the overall housing market. And when a contract falls through, that doesn’t automatically mean the house won’t sell at all. In many cases, another buyer steps in. Sometimes it’s the person whose offer was originally beaten out in a multiple-offer situation. Other times it’s a completely new buyer who comes along once the home returns to active status. For sellers, a cancellation can certainly be frustrating, but it’s rarely the end of the road. And for buyers, it’s not evidence that “everyone else knows something you don’t.” It’s just something that happens to a certain percentage of real estate transactions each and every day, week, month, and year. Why Local Context (And Your Agent) Matter Most Because cancellations are a normal part of the process, the real question isn’t whether they happen… it’s whether they’re likely to happen to you, and how you handle it if it happens. National headlines talk in broad percentages. But real estate market conditions can vary significantly from one city to another, from one neighborhood to the next, and even between different price points within the same town. An experienced local agent can give you perspective on what’s happening specifically in your market, not just what’s happening nationally. More importantly, a good agent can often help reduce the likelihood of a contract falling through in the first place. That might mean properly vetting a buyer’s financing, structuring smart contingencies, pricing strategically, anticipating appraisal challenges, or identifying potential red flags early. But most importantly, when a cancellation does happen (and sometimes it will), an experienced agent can help you stay calm and make rational decisions instead of emotional ones. The Takeaway: According to recent headlines, real estate contract cancellations are at their highest January level since 2017. However, while that might sound alarming, it’s only a 0.6 percentage point increase compared to last January, and a 2.7 percentage point increase compared to January 2017. While those claims are factually correct, cancellations are a normal occurrence, and the increases are not as drastic as they may sound. Headlines are designed to grab attention. Before letting a headline impact whether you decide to buy or sell a home, make sure you’re looking at the full picture — ideally with a local agent who understands how it applies to you locally.